Upcoming Tax Reform Could Make Yacht Ownership a Smarter Investment

The 2025 Tax Reform could reshape the financial landscape for yacht buyers and current owners, unlocking significant yacht ownership tax benefits, especially for those leveraging their vessel for business. Whether you’re considering entering the yacht market or already own a yacht, understanding these proposed tax advantages to make a smarter investment.

Key Proposed Tax Benefits for Yacht Owners and Investors

If passed as expected, the revised tax code could offer substantial benefits for those considering yacht ownership as part of their investment or business strategy. View below a summary of the most notable proposed changes:

1. Bonus Depreciation – Yacht Ownership Tax Benefits

Current Status: The Tax Cuts and Jobs Act (TCJA) provided 100% bonus depreciation for qualifying property placed in service between September 27, 2017, and January 1, 2023. This provision is currently 40% for 2025.

Proposed Changes: The House Ways and Means Committee’s tax framework proposes restoring 100% bonus depreciation for qualifying property acquired after January 19, 2025, and placed in service before 2030.

Final Impact on Yacht Ownership Tax Benefits: By placing your yacht in a qualified charter business, you can benefit from substantial first-year depreciation and significantly improve your return on investment.

2. Qualified Business Income (QBI) Deduction

Current Status: The TCJA introduced a 20% deduction for qualified business income from pass-through entities, which may apply to charter income if the operation qualifies as a trade or business.

Proposed Changes: The QBI deduction is currently scheduled to sunset at the end of 2025, though further legislative action may extend or modify this benefit according to J.P. Morgan Private Bank.

Impact on Yacht Charter Businesses: Yacht charter income qualifies as QBI, providing owners with access to substantial tax deductions that can directly improve profitability.

3. Section 179 Write-Offs

Proposed Changes: The proposed reform would permanently increase the maximum amount a taxpayer may expense under Section 179 to $2.5 million, with the phaseout threshold rising to $4 million, effective in 2025.

Impact on Yacht Owners: This change allows for greater flexibility and significant upfront tax deductions when a yacht is acquired and placed into a qualified charter business.

View this video with CPA, Ryan Deangler, with Lombardo & Ayers, as he explains the business yacht ownership model.

Consult a qualified tax professional to ensure compliance and maximize benefits based on your circumstances.

Conclusion

For investors and entrepreneurs considering yacht ownership, the 2025 Tax Reform could present significant tax benefits for yacht ownership. This strategic opportunity offers significant tax advantages, especially when the vessel is used for qualified business purposes.

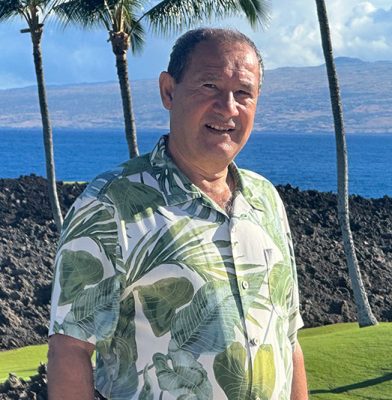

Ahmad Mohammadi, Principal Broker

CEO & Founder, Hawaii Luxury Yachts – ACY Hawaii